Client Manager and Government expert, Bianca Jaensch outlines round 1 of grants for the SA tourism, hospitality and gym operators including the benefits and eligibility requirements.

On the 27th of December 2021, funding for SA tourism, hospitality and gym operators’ have been made available for business’ whose turnover has been significantly impacted by COVID-19 restrictions.

Overview

- There are 2 assistance streams that have been made available for both employing and non-employing businesses in the tourism, hospitality and gym sectors which consists of an automatic payment and a turnover based payment.

- Grants of up to $22,000 for eligible tourism and hospitality businesses and gyms, which includes automatic payments of up to $11,000 for businesses that previously received the Additional Covid Business Support grant.

- Businesses can also get another grant of up to $11,000 by applying, if their turnover dropped by 30 percent in the two weeks starting December 27.

- Eligible businesses other than hospitality, tourism and gyms can apply for an $8000 grant while affected major events that were cancelled or postponed can receive grants of up to $100,000.

- Payroll tax deferral for tourism, hospitality and gyms affected by the trading restrictions upon application to RevenueSA and some liquor licence holders can have the remaining half of fees waived.

Automatic payment

This grant is automatically paid to businesses that received the previous COVID-19 Tourism and Hospitality Support Grants, as well as other businesses that received the Additional COVID-19 Business Support Grant and fall within the eligibility criteria.

No application is necessary. The automatic payments would have been made in the week beginning 4 January 2022.

Turnover based payment December

Businesses that fall within the eligibility criteria that were required to operate under the 1 person per 7 square metre density restriction can apply for this grant.

A business does not need to have received the ‘tourism, hospitality, and gym grant – automatic payment’ to be eligible for this grant.

Eligibility

At the start of the restriction period of 27 December 2021, businesses must:

- have a valid and active Australian business number (ABN)

- be registered for goods and services tax (GST)

- be located/operating within South Australia

- have an Australia-wide grouped payroll of less than $10 million in the 2019-20 or 2020-21 financial year

- have experienced at least a 30% reduction in turnover due to the restricted trading conditions over the 2 weeks from 27 December 2021 (the commencement date of the trading restriction) to 9 January 2022 compared to:

- the comparable 2 weeks in 2019-20 for businesses actively trading in 2019-20, or

- the comparable 2 weeks in 2020-21 for businesses not actively trading in 2019-20.

Closing Date

Applications close midnight 31 March 2022.

Applications are required to be submitted online via the Application portal.

Round 2 Grants:

An additional round of Grants have been made available for the periods 10 January 2022 and 30 January 2022. To be eligible for the Tourism, Hospitality and Gym Grant – Additional Round – January 2022 a business must meet the same eligibility criteria as the first grant. However, please see below for the turnover decline dates for this period.

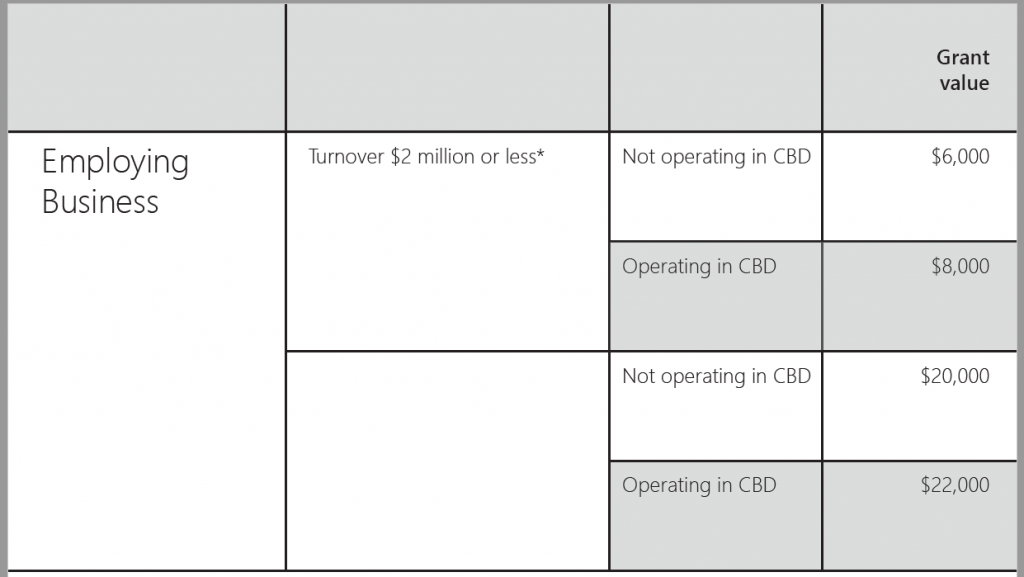

Employing Businesses:

Grant Amounts

The value of the COVID-19 Tourism, Hospitality and Gym Grants – Additional Round – January 2022 are summarised in the table below:

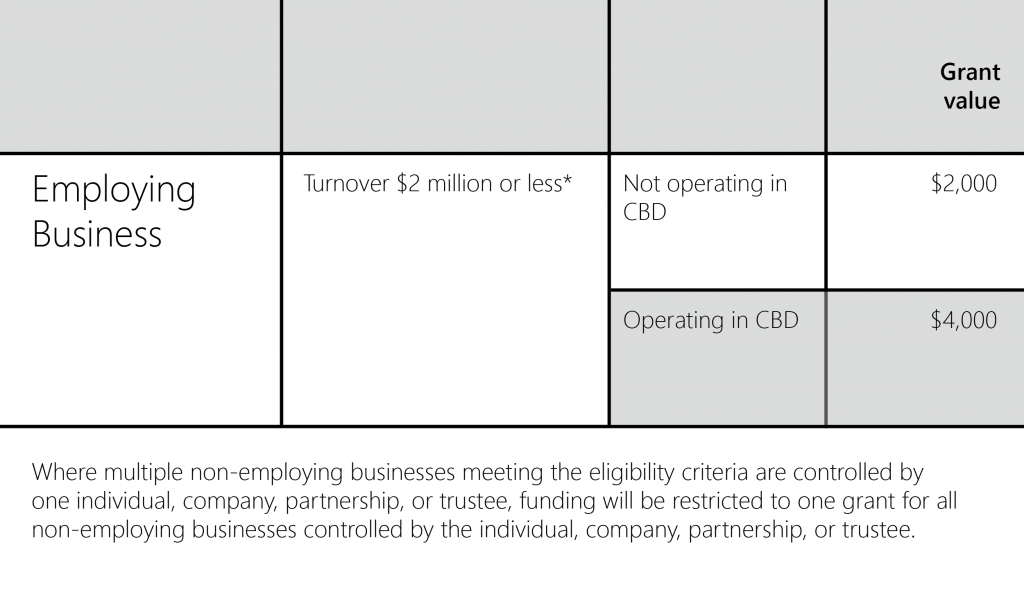

Non-Employing Businesses:

Grant Amounts

The value of the COVID-19 Tourism, Hospitality and Gym Grants – Additional Round – January 2022 are summarised in the table below:

Turnover Decline

An eligible business that commenced operations before 1 December 2020 must declare and retain evidence of the following:

- For businesses that commenced trading prior to 2019-20:The relevant three-week period between 10 January 2022 and 30 January 2022 (inclusive) where it experienced a 30 per cent reduction in turnover when compared to the same three-week period (i.e. 10 January to 30 January) in 2019-20.

- For businesses that commenced trading in 2019-20 or 2020-21 (before 1 December 2020):The relevant three-week period between 10 January 2022 and 30 January 2022 (inclusive) where it experienced a 30 per cent reduction in turnover when compared to the same three-week period (i.e. 10 January to 30 January) in 2019-20 or 2020-21.

An eligible business that commenced operations on or after 1 December 2020 must declare and retain evidence that it has experienced at least a 30 per cent reduction in turnover due to the restricted trading conditions over the three-week period between 10 January 2022 and 30 January 2022 (inclusive) compared to:

- The average weekly turnover from when the business commenced operations to 30 November 2021, multiplied by 3 (ie average turnover over 3 weeks).

Closing Date

Applications close midnight 31 March 2022.

If you would like assistance in completing the application or for more information, please do not hesitate to contact our office on (08) 8172 9150 or info@mastertax.com.au